Aims and Scope

Financial Metrics in Business (FMB) (eISSN: 3082-8341) is an open-access, peer-reviewed international journal dedicated to advancing the understanding and application of financial metrics in the global business landscape. The journal serves as a platform for scholars, practitioners, and policymakers to share innovative research, insights, and best practices that bridge the gap between theory and practice in financial measurement and analysis. FMB is committed to fostering a rigorous and collaborative academic environment. By promoting open access, we aim to ensure that our content reaches a global audience, facilitating knowledge exchange and practical applications that drive financial innovation and decision-making in business.

Financial Metrics in Business (FMB) (eISSN: 3082-8341) is an open-access, peer-reviewed international journal dedicated to advancing the understanding and application of financial metrics in the global business landscape. The journal serves as a platform for scholars, practitioners, and policymakers to share innovative research, insights, and best practices that bridge the gap between theory and practice in financial measurement and analysis. FMB is committed to fostering a rigorous and collaborative academic environment. By promoting open access, we aim to ensure that our content reaches a global audience, facilitating knowledge exchange and practical applications that drive financial innovation and decision-making in business.

FMB welcomes high-quality, original research articles, reviews, and case studies that explore the development, implementation, and impact of financial metrics across various domains, including but not limited to corporate finance, investment analysis, risk management, financial reporting, sustainability accounting, and performance evaluation. We encourage interdisciplinary approaches that integrate financial metrics with emerging technologies, behavioral finance, and global economic trends.

The journal encompasses a broad range of topics including but not limited to the following areas:

• Corporate Finance Metrics;

• Investment and Portfolio Analysis;

• Risk Management and Financial Stability;

• Financial Reporting and Analysis;

• Emerging Trends and Technologies;

• Global and Cross-Cultural Perspectives;

• etc.

Current Issue

Case Study

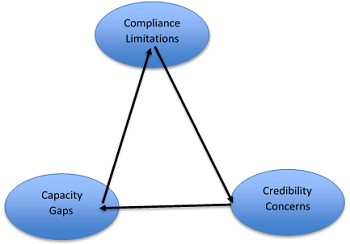

This study evaluates the preparedness of Gambian state-owned enterprises (SOEs), with emphasis on the National Water and Electricity Company (NAWEC), to adopt sustainability disclosures consistent with international Environmental, Social, and Governance (ESG) standards. Employing a qualitative case study approach, the research combines documentary analysis with 20 semi-structured interviews involving SOE executives, government regulators, and independent auditors. The analysis applies a three-dimensional framework capacity, compliance, and credibility to assess institutional readiness. Results indicate systemic limitations: institutional capacity is constrained by the absence of dedicated ESG units, fragmented information systems, and insufficient staff expertise; compliance is weakened by the absence of statutory reporting obligations, producing donor-driven and selective disclosures; while credibility is undermined by weak verification practices and the lack of third-party assurance. These deficiencies interact in a reinforcing cycle, perpetuating low-quality reporting and eroding stakeholder trust. Theoretically, the study contributes by integrating stakeholder and legitimacy perspectives into a context-specific model for understanding ESG reporting in low- and middle-income countries (LMICs). Practically, it highlights the need for phased legal mandates, capacity development in human resources and digital infrastructure, and the introduction of limited-scope assurance to enhance disclosure quality. The findings demonstrate that improving ESG reporting in The Gambia not only strengthens accountability and transparency but also positions SOEs to access sustainable financing and align with global governance reforms. This research represents the first empirical assessment of ESG reporting readiness in The Gambia, offering insights that extend to similar LMIC contexts where institutional frameworks remain underdeveloped.

| eISSN: 2717-5340 (old) Abbreviation: Financ Metr Bus Editor-in-Chief: Prof. Dr. Hideaki Sakawa(Japan) Publishing Frequency: Continuous publication Article Processing Charges (APC): Click here for more details Publishing Model: Open Access |

Lamin K. Drammeh, Driana Leniwati

Lamin K. Drammeh, Driana Leniwati