Global Oil Price Jumps and China’s New Energy Sector: New Evidence from Dynamic Volatility Models

Main Article Content

Abstract

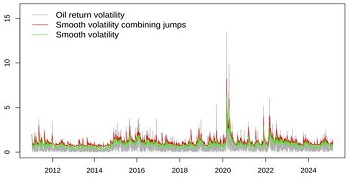

Intensifying geopolitical tensions have recently amplified fluctuations in global crude oil prices, where abrupt price jumps often transmit complex spillovers across energy markets. This paper investigates the asymmetric, heterogeneous, and lagged impacts of oil price jump shocks on China's new energy industry at both aggregate and sub-industry levels spanning the full upstream-midstream-downstream industrial chain. Using an ARMA-EGARCH-ARJI framework, global oil price dynamics are modeled to capture volatility clustering and discrete jumps, while expected/unexpected and lag structures are applied to examine asymmetric and delayed responses. The results reveal a unique asymmetric pattern of dual inhibition/promotion: both expected increases and decreases in oil prices suppress new energy returns, whereas unexpected jumps stimulate the sector. The effects are heterogeneous across sub-industries, with upstream sectors showing weaker sensitivity to anticipated shocks. Moreover, the influence of oil price jumps unfolds with notable time lags. These findings underscore the structural tensions between market-oriented energy transformation and policy inertia, offering implications to enhance the resilience and efficiency of China's new energy transition.

Article Details

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

References

- Barndorff-Nielsen OE. Power and Bipower Variation with Stochastic Volatility and Jumps. Journal of Financial Econometrics. 2004, 2(1): 1-37. https://doi.org/10.1093/jjfinec/nbh001

- Lee SS, Mykland PA. Jumps in Financial Markets: A New Nonparametric Test and Jump Dynamics. Review of Financial Studies. 2007, 21(6): 2535-2563. https://doi.org/10.1093/rfs/hhm056

- Lee YH, Hu HN, Chiou JS. Jump dynamics with structural breaks for crude oil prices. Energy Economics. 2010, 32(2): 343-350. https://doi.org/10.1016/j.eneco.2009.08.006

- Bjursell J, Gentle JE, Wang GHK. Inventory announcements, jump dynamics, volatility and trading volume in U.S. energy futures markets. Energy Economics. 2015, 48: 336-349. https://doi.org/10.1016/j.eneco.2014.11.006

- Dutta A, Bouri E, Roubaud D. Modelling the volatility of crude oil returns: Jumps and volatility forecasts. International Journal of Finance & Economics. 2020, 26(1): 889-897. https://doi.org/10.1002/ijfe.1826

- Dutta A, Soytas U, Das D, et al. In search of time-varying jumps during the turmoil periods: Evidence from crude oil futures markets. Energy Economics. 2022, 114: 106275. https://doi.org/10.1016/j.eneco.2022.106275

- Zhang L, Chen Y, Bouri E. Time-varying jump intensity and volatility forecasting of crude oil returns. Energy Economics. 2024, 129: 107236. https://doi.org/10.1016/j.eneco.2023.107236

- Deng X, Xu F. Connectedness between international oil and China’s new energy industry chain: A time-frequency analysis based on TVP-VAR model. Energy Economics. 2024, 140: 107954. https://doi.org/10.1016/j.eneco.2024.107954

- Su X, He J. Does the crude oil return matter for the new energy vehicle-related industry markets? — A comparison of complete vehicles, energy systems, and raw materials. Energy Economics. 2025, 144: 108339. https://doi.org/10.1016/j.eneco.2025.108339

- Askari H, Krichene N. Oil price dynamics (2002–2006). Energy Economics. 2008, 30(5): 2134-2153. https://doi.org/10.1016/j.eneco.2007.12.004

- Larsson K, Nossman M. Jumps and stochastic volatility in oil prices: Time series evidence. Energy Economics. 2011, 33(3): 504-514. https://doi.org/10.1016/j.eneco.2010.12.016

- Baum CF, Zerilli P. Jumps and stochastic volatility in crude oil futures prices using conditional moments of integrated volatility. Energy Economics. 2016, 53: 175-181. https://doi.org/10.1016/j.eneco.2014.10.007

- Bollerslev T. Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics. 1986, 31(3): 307-327. https://doi.org/10.1016/0304-4076(86)90063-1

- Gronwald M. A characterization of oil price behavior -- Evidence from jump models. Energy Economics. 2012, 34(5): 1310-1317. https://doi.org/10.1016/j.eneco.2012.06.006

- Wilmot NA, Mason CF. Jump Processes in the Market for Crude Oil. The Energy Journal. 2013, 34(1): 33-48. https://doi.org/10.5547/01956574.34.1.2

- Du L, Yanan H, Wei C. The relationship between oil price shocks and China’s macro-economy: An empirical analysis. Energy Policy. 2010, 38(8): 4142-4151. https://doi.org/10.1016/j.enpol.2010.03.042

- Taghizadeh-Hesary F, Yoshino N, Mohammadi Hossein Abadi M, et al. Response of macro variables of emerging and developed oil importers to oil price movements. Journal of the Asia Pacific Economy. 2015, 21(1): 91-102. https://doi.org/10.1080/13547860.2015.1057955

- Zhao L, Zhang X, Wang S, et al. The effects of oil price shocks on output and inflation in China. Energy Economics. 2016, 53: 101-110. https://doi.org/10.1016/j.eneco.2014.11.017

- Yildirim Z, Guloglu H. Macro-financial transmission of global oil shocks to BRIC countries — International financial (uncertainty) conditions matter. Energy. 2024, 306: 132297. https://doi.org/10.1016/j.energy.2024.132297

- Kim WJ, Hammoudeh S, Hyun JS, et al. Oil price shocks and China’s economy: Reactions of the monetary policy to oil price shocks. Energy Economics. 2017, 62: 61-69. https://doi.org/10.1016/j.eneco.2016.12.007

- Togonidze S, Kočenda E. Macroeconomic responses of emerging market economies to oil price shocks: An analysis by region and resource profile. Economic Systems. 2022, 46(3): 100988. https://doi.org/10.1016/j.ecosys.2022.100988

- Lee K, Ni S. On the dynamic effects of oil price shocks: a study using industry level data. Journal of Monetary Economics. 2002, 49(4): 823-852. https://doi.org/10.1016/s0304-3932(02)00114-9

- Cong RG, Wei YM, Jiao JL, et al. Relationships between oil price shocks and stock market: An empirical analysis from China. Energy Policy. 2008, 36(9): 3544-3553. https://doi.org/10.1016/j.enpol.2008.06.006

- Zhang C, Qu X. The effect of global oil price shocks on China’s agricultural commodities. Energy Economics. 2015, 51: 354-364. https://doi.org/10.1016/j.eneco.2015.07.012

- Zhu H, Guo Y, You W, et al. The heterogeneity dependence between crude oil price changes and industry stock market returns in China: Evidence from a quantile regression approach. Energy Economics. 2016, 55: 30-41. https://doi.org/10.1016/j.eneco.2015.12.027

- Zhu X, Liao J, Chen Y. Time-varying effects of oil price shocks and economic policy uncertainty on the nonferrous metals industry: From the perspective of industrial security. Energy Economics. 2021, 97: 105192. https://doi.org/10.1016/j.eneco.2021.105192

- Sun Z, Cai X, Huang WC. The Impact of Oil Price Fluctuations on Consumption, Output, and Investment in China’s Industrial Sectors. Energies. 2022, 15(9): 3411. https://doi.org/10.3390/en15093411

- Wang KH, Su CW, Xiao Y, et al. Is the oil price a barometer of China’s automobile market? From a wavelet-based quantile-on-quantile regression perspective. Energy. 2022, 240: 122501. https://doi.org/10.1016/j.energy.2021.122501

- Henriques I, Sadorsky P. Oil prices and the stock prices of alternative energy companies. Energy Economics. 2008, 30(3): 998-1010. https://doi.org/10.1016/j.eneco.2007.11.001

- Kumar S, Managi S, Matsuda A. Stock prices of clean energy firms, oil and carbon markets: A vector autoregressive analysis. Energy Economics. 2012, 34(1): 215-226. https://doi.org/10.1016/j.eneco.2011.03.002

- Managi S, Okimoto T. Does the price of oil interact with clean energy prices in the stock market? Japan and the World Economy. 2013, 27: 1-9. https://doi.org/10.1016/j.japwor.2013.03.003

- Bondia R, Ghosh S, Kanjilal K. International crude oil prices and the stock prices of clean energy and technology companies: Evidence from non-linear cointegration tests with unknown structural breaks. Energy. 2016, 101: 558-565. https://doi.org/10.1016/j.energy.2016.02.031

- Reboredo JC, Rivera-Castro MA, Ugolini A. Wavelet-based test of co-movement and causality between oil and renewable energy stock prices. Energy Economics. 2017, 61: 241-252. https://doi.org/10.1016/j.eneco.2016.10.015

- Sadorsky P. Correlations and volatility spillovers between oil prices and the stock prices of clean energy and technology companies. Energy Economics. 2012, 34(1): 248-255. https://doi.org/10.1016/j.eneco.2011.03.006

- He X, Mishra S, Aman A, et al. The linkage between clean energy stocks and the fluctuations in oil price and financial stress in the US and Europe? Evidence from QARDL approach. Resources Policy. 2021, 72: 102021. https://doi.org/10.1016/j.resourpol.2021.102021

- Reboredo JC. Is there dependence and systemic risk between oil and renewable energy stock prices? Energy Economics. 2015, 48: 32-45. https://doi.org/10.1016/j.eneco.2014.12.009

- Elie B, Naji J, Dutta A, et al. Gold and crude oil as safe-haven assets for clean energy stock indices: Blended copulas approach. Energy. 2019, 178: 544-553. https://doi.org/10.1016/j.energy.2019.04.155

- Broadstock DC, Cao H, Zhang D. Oil shocks and their impact on energy related stocks in China. Energy Economics. 2012, 34(6): 1888-1895. https://doi.org/10.1016/j.eneco.2012.08.008

- Wen X, Guo Y, Wei Y, et al. How do the stock prices of new energy and fossil fuel companies correlate? Evidence from China. Energy Economics. 2014, 41: 63-75. https://doi.org/10.1016/j.eneco.2013.10.018

- Chan WH, Maheu JM. Conditional Jump Dynamics in Stock Market Returns. Journal of Business & Economic Statistics. 2002, 20(3): 377-389. https://doi.org/10.1198/073500102288618513

- Engle RF, NG VK. Measuring and Testing the Impact of News on Volatility. The Journal of Finance. 1993, 48(5): 1749-1778. https://doi.org/10.1111/j.1540-6261.1993.tb05127.x

- Maheu JM, McCurdy TH. News Arrival, Jump Dynamics, and Volatility Components for Individual Stock Returns. The Journal of Finance. 2004, 59(2): 755-793. https://doi.org/10.1111/j.1540-6261.2004.00648.x

- Kilian L. Not All Oil Price Shocks Are Alike: Disentangling Demand and Supply Shocks in the Crude Oil Market. American Economic Review. 2009, 99(3): 1053-1069. https://doi.org/10.1257/aer.99.3.1053

- Zhang H, Cai G, Yang D. The impact of oil price shocks on clean energy stocks: Fresh evidence from multi-scale perspective. Energy. 2020, 196: 117099. https://doi.org/10.1016/j.energy.2020.117099

- Zhang Y, Tang G, Li R. Spillover effects between China’s new energy and carbon markets and international crude oil market: A look at the impact of extreme events. International Review of Economics & Finance. 2025, 98: 103939. https://doi.org/10.1016/j.iref.2025.103939

- Reboredo JC, Ugolini A. The impact of energy prices on clean energy stock prices. A multivariate quantile dependence approach. Energy Economics. 2018, 76: 136-152. https://doi.org/10.1016/j.eneco.2018.10.012

- Kilian L, Park C. The Impact of Oil Price Shocks on the U.S. Stock Market. International Economic Review. 2009, 50(4): 1267-1287. https://doi.org/10.1111/j.1468-2354.2009.00568.x

- Bernanke BS, Gertler M, Watson M, et al. Systematic Monetary Policy and the Effects of Oil Price Shocks. Brookings Papers on Economic Activity. 1997, 1997(1): 91. https://doi.org/10.2307/2534702

- Radchenko S. Lags in the response of gasoline prices to changes in crude oil prices: The role of short-term and long-term shocks. Energy Economics. 2005, 27(4): 573-602. https://doi.org/10.1016/j.eneco.2005.04.004