Vol 8 No 1 (2026)

Research Article

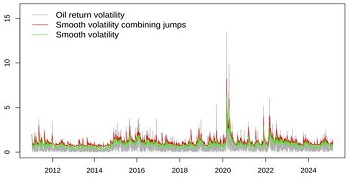

Global Oil Price Jumps and China’s New Energy Sector: New Evidence from Dynamic Volatility Models

Intensifying geopolitical tensions have recently amplified fluctuations in global crude oil prices, where abrupt price jumps often transmit complex spillovers across energy markets. This paper investigates the asymmetric, heterogeneous, and lagged impacts of oil price jump shocks on China's new energy industry at both aggregate and sub-industry levels spanning the full upstream-midstream-downstream industrial chain. Using an ARMA-EGARCH-ARJI framework, global oil price dynamics are modeled to capture volatility clustering and discrete jumps, while expected/unexpected and lag structures are applied to examine asymmetric and delayed responses. The results reveal a unique asymmetric pattern of dual inhibition/promotion: both expected increases and decreases in oil prices suppress new energy returns, whereas unexpected jumps stimulate the sector. The effects are heterogeneous across sub-industries, with upstream sectors showing weaker sensitivity to anticipated shocks. Moreover, the influence of oil price jumps unfolds with notable time lags. These findings underscore the evolving interplay between market-oriented energy transformation and policy stability, offering implications to enhance the resilience and efficiency of China's new energy transition.

Chuanguo Zhang, Yujie Du

Chuanguo Zhang, Yujie Du