The Environmental, Social, and Governance Reporting in The Gambia’s State-Owned Enterprises: A Case Study of the National Water and Electricity Company (NAWEC)

Main Article Content

Abstract

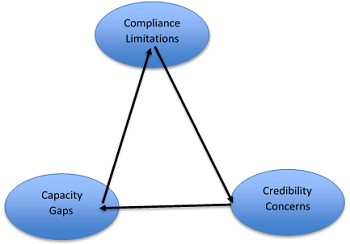

This study evaluates the preparedness of Gambian state-owned enterprises (SOEs), with emphasis on the National Water and Electricity Company (NAWEC), to adopt sustainability disclosures consistent with international Environmental, Social, and Governance (ESG) standards. Employing a qualitative case study approach, the research combines documentary analysis with 20 semi-structured interviews involving SOE executives, government regulators, and independent auditors. The analysis applies a three-dimensional framework capacity, compliance, and credibility to assess institutional readiness. Results indicate systemic limitations: institutional capacity is constrained by the absence of dedicated ESG units, fragmented information systems, and insufficient staff expertise; compliance is weakened by the absence of statutory reporting obligations, producing donor-driven and selective disclosures; while credibility is undermined by weak verification practices and the lack of third-party assurance. These deficiencies interact in a reinforcing cycle, perpetuating low-quality reporting and eroding stakeholder trust. Theoretically, the study contributes by integrating stakeholder and legitimacy perspectives into a context-specific model for understanding ESG reporting in low- and middle-income countries (LMICs). Practically, it highlights the need for phased legal mandates, capacity development in human resources and digital infrastructure, and the introduction of limited-scope assurance to enhance disclosure quality. The findings demonstrate that improving ESG reporting in The Gambia not only strengthens accountability and transparency but also positions SOEs to access sustainable financing and align with global governance reforms. This research represents the first empirical assessment of ESG reporting readiness in The Gambia, offering insights that extend to similar LMIC contexts where institutional frameworks remain underdeveloped.

Article Details

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

References

- Adu, D. A. (2022). Competition and bank risk-taking in Sub-Saharan Africa countries. SN Business & Economics, 2(7). https://doi.org/10.1007/s43546-022-00250-1

- Agyemang-Badu, A. A., Ibrahim, M., Olmedo, F. G., Menan, G. R., Obregón, J. A., & Tsafack, H. K. (2021). Overview Of Africa’s Financial Sector Long Term-Finance and Capital Markets1. Boletín Económico de ICE, 3135.

- Akula, H. (2024). Align and Accelerate Nations ESG Leadership Efforts With Implementation of SDG17 Partnership Effects. Available at SSRN 5352035.

- Ansah, E. W., Amoadu, M., Obeng, P., & Sarfo, J. O. (2024). Climate change, urban vulnerabilities and adaptation in Africa: a scoping review. Climatic Change, 177(4). https://doi.org/10.1007/s10584-024-03711-8

- Aschauer, E., & Quick, R. (2024). Implementing shared service centres in Big 4 audit firms: an exploratory study guided by institutional theory. Accounting, Auditing & Accountability Journal, 37(9), 1–28. https://doi.org/10.1108/aaaj-07-2021-5376

- Awa, H. O., Etim, W., & Ogbonda, E. (2024). Stakeholders, stakeholder theory and Corporate Social Responsibility (CSR). International Journal of Corporate Social Responsibility, 9(1). https://doi.org/10.1186/s40991-024-00094-y

- Boiral, O., Heras-Saizarbitoria, I., & Brotherton, M.-C. (2017). Assessing and Improving the Quality of Sustainability Reports: The Auditors’ Perspective. Journal of Business Ethics, 155(3), 703–721. https://doi.org/10.1007/s10551-017-3516-4

- Børtveit, L., Nordgreen, T., & Nordahl-Hansen, A. (2024). Exploring experiences with an internet-delivered ACT intervention among individuals with a personal history of depression: A thematic analysis. Acta Psychologica, 250, 104510. https://doi.org/10.1016/j.actpsy.2024.104510

- Bowen, G., Appiah, D., & Okafor, S. (2020). The Influence of Corporate Social Responsibility (CSR) and Social Media on the Strategy Formulation Process. Sustainability, 12(15), 6057. https://doi.org/10.3390/su12156057

- Castilla-Polo, F., García-Martínez, G., Guerrero-Baena, M. D., & Polo-Garrido, F. (2024). The cooperative ESG disclosure index: an empirical approach. Environment, Development and Sustainability, 27(8), 18699–18724. https://doi.org/10.1007/s10668-024-04719-x

- Chand, S. P. (2025). Methods of Data Collection in Qualitative Research: Interviews, Focus Groups, Observations, and Document Analysis. Advances in Educational Research and Evaluation, 6(1), 303–317. https://doi.org/10.25082/aere.2025.01.001

- Dolbec, P.-Y., Castilhos, R. B., Fonseca, M. J., & Trez, G. (2021). How Established Organizations Combine Logics to Reconfigure Resources and Adapt to Marketization: A Case Study of Brazilian Religious Schools. Journal of Marketing Research, 59(1), 118–135. https://doi.org/10.1177/0022243721999042

- Faccia, A., Manni, F., & Capitanio, F. (2021). Mandatory ESG Reporting and XBRL Taxonomies Combination: ESG Ratings and Income Statement, a Sustainable Value-Added Disclosure. Sustainability, 13(16), 8876. https://doi.org/10.3390/su13168876

- Fonseca, D. R. da, Camões, M. R. de S., Cavalcante, P. L. C., Lemos, J., & Palotti, P. L. de M. (2019). Schools of Government’s roles and challenges for institutionalization: a comparative study in the Brazilian Federal Public Sector. Revista Do Serviço Público, 70, 71–106. https://doi.org/10.21874/rsp.v70i0.1458

- Hadia Ashraf. (2025). Corporate Governance and its Global Trends: Need to formulate Effective Strategies for Sustainable Economic Growth of Pakistan Journal of Management & Social Science, 2(2), 416–425. https://doi.org/10.63075/ytbyn415

- Harris, L.-A., Watkins, D., Williams, L. D., & Koudelka, G. B. (2013). Indirect Readout of DNA Sequence by P22 Repressor: Roles of DNA and Protein Functional Groups in Modulating DNA Conformation. Journal of Molecular Biology, 425(1), 133–143. https://doi.org/10.1016/j.jmb.2012.10.008

- Herberg, M., & Torgersen, G.-E. (2021). Resilience Competence Face Framework for the Unforeseen: Relations, Emotions and Cognition. A Qualitative Study. Frontiers in Psychology, 12. https://doi.org/10.3389/fpsyg.2021.669904

- Houérou, P. Le, & Lankes, H. P. (2023). Mustering the private sector for development and climate in the Global South: Is it realistic? Lessons and recommendations from an on-going experiment at the World Bank Group. Fondation Pour Les Études et Recherches Sur Le Développement International, 3(2023), 51.

- Humphrey, P., Dures, E., Hoskin, P., & Cramp, F. (2024). Patient Experiences of Brachytherapy for Locally Advanced Cervical Cancer: Hearing the Patient Voice Through Qualitative Interviews. International Journal of Radiation Oncology*Biology*Physics, 119(3), 902–911. https://doi.org/10.1016/j.ijrobp.2023.12.016

- Karino, E., Ndegwa, J., & Were, V. (2025). Perspectives of Healthcare Managers, Policymakers, and Financial Experts on the Effectiveness of Asset Leasing in Enhancing Tertiary Healthcare Quality in Kenya. https://doi.org/10.21203/rs.3.rs-6939933/v1

- Krasodomska, J., Simnett, R., & Street, D. L. (2021). Extended external reporting assurance: Current practices and challenges. Journal of International Financial Management & Accounting, 32(1), 104–142. Portico. https://doi.org/10.1111/jifm.12127

- Lähteenmäki-Smith, K., Manu, S., Vartiainen, P., Uusikylä, P., Jalonen, H., Kotiranta, S., ... & Mertsola, S. (2021). Government steering beyond 2020: From regulatory and resource management to systems navigation.

- Lai, A., & Stacchezzini, R. (2021). Organisational and professional challenges amid the evolution of sustainability reporting: a theoretical framework and an agenda for future research. Meditari Accountancy Research, 29(3), 405–429. https://doi.org/10.1108/medar-02-2021-1199

- Lee, J., Serafin, A. M., & Courteau, C. (2023). Corporate disclosure, ESG and green fintech in the energy industry. The Journal of World Energy Law & Business, 16(6), 473–491. https://doi.org/10.1093/jwelb/jwad018

- Lim, W. M. (2024). What Is Qualitative Research? An Overview and Guidelines. Australasian Marketing Journal, 33(2), 199–229. https://doi.org/10.1177/14413582241264619

- Manneh, M. (2020). Challenges and possible solutions to electricity generation, transmission and distribution in the Gambia. American International Journal of Business Management, 3, 87-93.

- Manneh, M. (2020). Opportunities and Constraints of Scaling Up Electricity Access in the Gambia. Oman Chapter of Arabian Journal of Business and Management Review, 9(3), 134–141. https://doi.org/10.12816/0059038

- Misman, S. N., & Adnan, I. H. (2023). A study on the malaysian sustainability reporting guidelines for islamic financial institutions. International Journal of Islamic Economics and Finance Research, 1, 103-115. https://doi.org/10.53840/ijiefer118

- Muzurura, J., & Mutambara, E. (2022). Effective Supreme Auditing Institutions, Sound Public Finance Management and National Development: Lessons for Zimbabwe’s Office of Auditor General. Humanities and Social Sciences Letters, 10(3), 223–237. https://doi.org/10.18488/73.v10i3.3017

- Nicolaides, A. (2015). Tourism Stakeholder Theory in practice: instrumental business grounds, fundamental normative demands or a descriptive application. African Journal of Hospitality, Tourism and Leisure, 4(2), 1-27.

- Nielsen, C. (2023). ESG Reporting and Metrics: From Double Materiality to Key Performance Indicators. Sustainability, 15(24), 16844. https://doi.org/10.3390/su152416844

- OECD. (2023). Green, social and sustainability bonds in developing countries: The case for increased donor co-ordination. OECD Publishing, Paris, 11(2 June 2023), 23–26.

- Ogie, R. I., Forehead, H., Clarke, R. J., & Perez, P. (2017). Participation Patterns and Reliability of Human Sensing in Crowd-Sourced Disaster Management. Information Systems Frontiers, 20(4), 713–728. https://doi.org/10.1007/s10796-017-9790-y

- Panagopoulos, A. G., & Tzionas, I. (2023). The Use of Sustainable Financial Instruments in Relation to the Social Impact Investment: ESG Policies, Capital Markets’ Approach and Investors’ Protection: An Innovative Perspective for a Global Surveillance Authority. International Journal of Business Administration, 14(1), 87. https://doi.org/10.5430/ijba.v14n1p87

- Panulo, B., & Van Staden, J. (2022). Understanding South African Development Finance Institutions to Promote Accountability. Bertha Centre: Cape Town, South Africa.

- Peteri, J. (2024). Challenges of Double Materiality Concept: Corporate Sustainability Directive (CSRD) in Finnish Companies.

- Roberts, W. A. F. (2023). Good Audit Quality for Prevention of Fraud and Corruption in the Public Sector. Evidence from Liberia. Evidence from Liberia, 1(86), 1–86.

- Sikiru, A. O., Chima, O. K., Otunba, M., Gaffar, O., & Adenuga, A. A. (2025). Navigating the Regulatory Trilemma - A Framework for Balancing U.S. Tariffs, EU ESG Directives, and Cross-Border Capital Controls. Engineering and Technology Journal, 10(08). https://doi.org/10.47191/etj/v10i08.38

- Tóth, Z. J. (2025). Internationalisation and Its Influence on Sustainability and Business Practices: A Study of Small and Medium-Sized Construction Materials Manufacturers in Hungary.